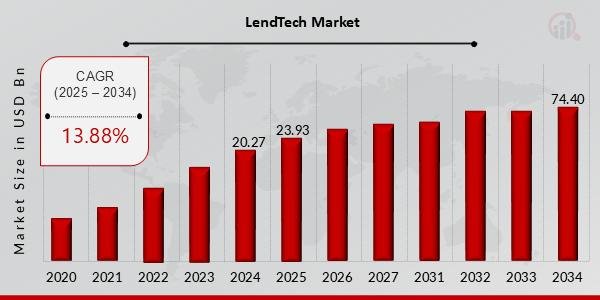

The LendTech market, a burgeoning sector at the intersection of lending and technology, is poised for remarkable expansion, with its market size projected to surge from $23.93 billion in 2025 to an impressive $74.40 billion by 2034. This represents a robust Compound Annual Growth Rate (CAGR) of 13.88% during the forecast period (2025-2034), indicating a significant shift in how individuals and businesses access and manage credit. The market was estimated at $20.27 billion in 2024.

This phenomenal growth is fueled by a confluence of factors, including the accelerating digital transformation of financial services, evolving consumer expectations for seamless experiences, and groundbreaking advancements in artificial intelligence (AI), machine learning (ML), and blockchain technology.

Get a Free PDF Sample: https://www.marketresearchfuture.com/sample_request/35334

Key Drivers Propelling the LendTech Market:

• Digital Transformation in Financial Services: The ongoing shift from traditional, paper-based lending processes to digital-first solutions is a primary catalyst. Borrowers increasingly demand faster, more convenient, and entirely online loan applications, approvals, and management. LendTech platforms cater to this demand by offering streamlined, user-friendly digital interfaces.

• Technological Advancements (AI, ML, Blockchain):

o Artificial Intelligence (AI) and Machine Learning (ML): These technologies are revolutionizing credit risk assessment, enabling lenders to analyze vast amounts of data, including alternative data sources (e.g., social media activity, online transactions, utility payments), to make more accurate and efficient lending decisions. AI-powered platforms automate loan approvals and personalize offerings based on borrower behavior, significantly enhancing operational efficiency and reducing turnaround times.

o Blockchain Technology: Blockchain enhances security and transparency in lending transactions through immutable records, mitigating fraud risks and fostering trust. It also has the potential to streamline sustainable investment processes and manage environmental risks.

• Increasing Demand for Quick and Efficient Loan Approvals: In today’s fast-paced world, consumers and businesses expect immediate access to funds. LendTech solutions, with their automated processes, significantly reduce the time taken for loan approvals compared to traditional methods.

• Rise of Alternative Lending Models: The emergence of peer-to-peer (P2P) lending, marketplace lending, and crowdfunding platforms has democratized access to credit, particularly for individuals and small businesses underserved by conventional financial institutions.

• Growing Adoption of Cloud Services: Cloud computing provides scalable infrastructure, advanced analytics, and robust security, enabling LendTech companies to manage resources efficiently and deliver faster, more secure, and reliable customer services.

• Evolving Regulatory Landscapes: While regulatory complexities pose a challenge, evolving regulations are also creating a more favorable environment for fintech lenders, pushing traditional institutions to adopt more flexible and efficient models.

• Focus on Financial Inclusion: LendTech plays a crucial role in expanding financial inclusion by offering accessible and affordable credit solutions to a wider population, including those with limited access to traditional banking services.

Browse Complete Research Report: https://www.marketresearchfuture.com/reports/lendtech-market-35334

Market Segmentation and Regional Dominance:

The LendTech market is broadly segmented by type (consumer lending, business lending), component (solution, services), deployment mode (on-premises, cloud), organization size (large enterprises, small and medium-sized enterprises), and end-user (banks, credit unions, non-banking financial companies (NBFCs)). Consumer lending, particularly personal loans, has shown significant growth due to the consumer desire for quick access to funds.

Geographically, North America has been a dominant force in the LendTech market, driven by its advanced infrastructure, high technology adoption rates, and a synergistic environment between established financial institutions and fintech startups. However, the Asia-Pacific region is projected to be the fastest-growing market in the forecast period, reflecting increasing digitalization initiatives and government support for LendTech in developing countries.

Challenges and Future Outlook:

Despite its immense growth potential, the LendTech market faces certain challenges:

• Regulatory Complexities: Navigating diverse and evolving regulatory frameworks across different jurisdictions remains a significant hurdle, impacting scalability and product offerings.

• Cybersecurity Risks: The increasing reliance on digital platforms makes sensitive borrower data vulnerable to breaches, necessitating robust data protection measures.

• High Acquisition Costs and Security Risks: These can hinder the growth of some LendTech firms.

• Building Customer Trust: Skepticism towards new technologies and concerns about data privacy can impact customer adoption.

Buy Premium Research Report: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=35334

However, the future of LendTech is undeniably bright. The continuous integration of AI, ML, and open banking will further refine credit assessment, enable personalized lending products, and enhance overall customer experience. The industry is moving towards a model where creditworthiness is continuously monitored, and lenders can proactively offer tailored support. As traditional financial institutions continue to embrace digital transformation and collaborate with LendTech innovators, the market is set to redefine the landscape of lending, making it more efficient, accessible, and responsive to the evolving needs of borrowers worldwide.

Related Reports:

US Digital Payment Healthcare Market https://www.marketresearchfuture.com/reports/us-digital-payment-healthcare-market-14092

US Financial Analytics Market https://www.marketresearchfuture.com/reports/us-financial-analytics-market-14342

US Investment Banking Market https://www.marketresearchfuture.com/reports/us-investment-banking-market-14860

US Digital Identity in BFSI Market https://www.marketresearchfuture.com/reports/us-digital-identity-in-bfsi-market-14926

US Web3 in Financial Services Market https://www.marketresearchfuture.com/reports/us-web3-in-financial-services-market-14935

US Applied AI in Finance Market https://www.marketresearchfuture.com/reports/us-applied-ai-in-finance-market-15001

US InsureTech Market https://www.marketresearchfuture.com/reports/us-insuretech-market-15390

US Blockchain Fintech Market https://www.marketresearchfuture.com/reports/us-blockchain-fintech-market-15630

US AI in Insurance Market https://www.marketresearchfuture.com/reports/us-ai-in-insurance-market-15880

US NLP in Finance Market https://www.marketresearchfuture.com/reports/us-nlp-in-finance-market-18203

Market Research Future (MRFR) is a global market research company that takes pride in its services, offering a complete and accurate analysis regarding diverse markets and consumers worldwide. Market Research Future has the distinguished objective of providing the optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Contact:

Market Research Future

99 Hudson Street,5Th Floor

New York, New York 10013

United States of America

Sales: +1 628 258 0071(US)

+44 2035 002 764(UK

Email: sales@marketresearchfuture.com

This release was published on openPR.