🔥 Bitcoin has always been the sleeping giant of DeFi, holding trillions in value yet staying outside of on-chain markets because liquidity providers couldn’t avoid impermanent loss. Yield Basis introduces the mathematical breakthrough that removes that handicap, turning Bitcoin’s volatility into sustainable yield while maintaining complete $BTC exposure. There are no volatility traps, no trade-offs, no impermanent loss, only transparent incentives powered by deep Curve liquidity.

Behind this masterwork stands Michael Egorov, the creator of Curve Finance, whose ve-token model reshaped stablecoin markets. With Yield Basis, he applies the same precision to Bitcoin itself through a self-balancing 2× BTC / crvUSD structure that mirrors BTC 1 : 1 and channels trading activity into yield.

At launch, deposits quickly reached the initial $150 million TVL cap, $50 million per market (tBTC, cbBTC, WBTC), and the $YB became the first token ever sold on Kraken Launch at $0.20.

When tokenized BTC is deposited, the protocol borrows an equal amount of crvUSD and forms a constant 2× leveraged position in the BTC / crvUSD pool on Curve Finance.

In a normal AMM, when BTC’s price moves, the pool automatically rebalances, selling BTC when it rises and buying BTC when it falls, creating impermanent loss that erodes position value as the protocol sells away exposure during BTC uptrends.

Yield Basis eliminates that problem. Its internal rebalancing mechanism maintains complete $BTC exposure while continuously earning trading fees. Arbitrage and automated AMM logic sustain the leverage, turning volatility into a source of income rather than risk.

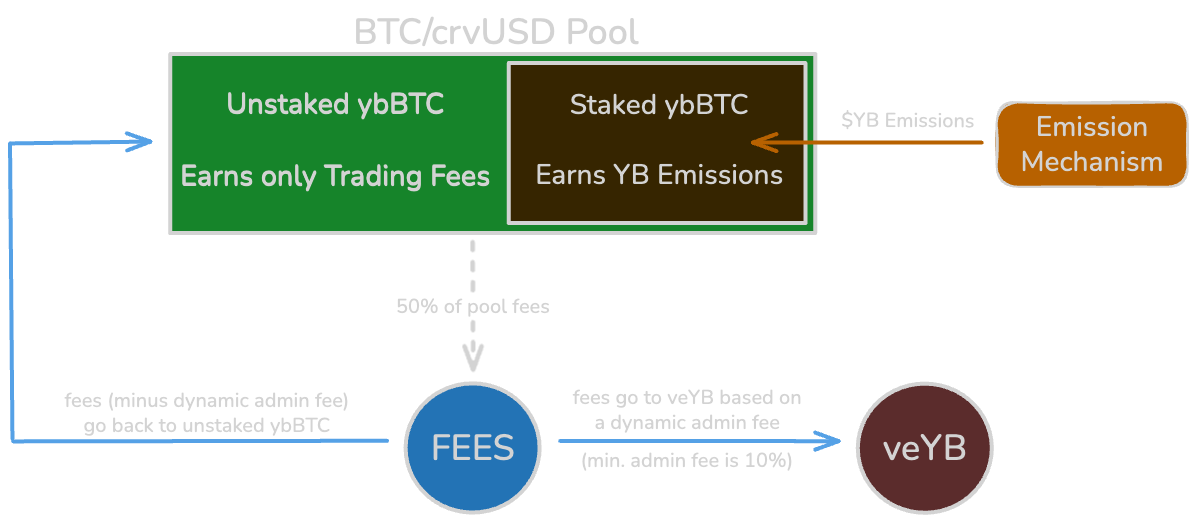

Each deposit issues ybBTC, a token representing your leveraged BTC position. You can then decide how to earn:

► Trading Yield → Keep ybBTC unstaked to collect BTC-denominated fees from Curve.

► Token Yield → Stake ybBTC to earn $YB emissions directed by veYB governance.

It’s a structural upgrade: the same mechanics that made Curve dominant for stablecoins, now applied to Bitcoin liquidity.

The $YB token powers both incentives and governance (total supply = 1 billion YB). Holders can lock YB for up to 4 years to mint veYB, which grants:

◆ voting rights to steer where YB emissions go,

◆ a share of protocol admin fees (distributed in BTC once activated),

◆ and greater influence the longer they lock.

This model connects liquidity, governance, and incentives in one loop — the longer participants commit, the more they earn.

Emission Structure:

Liquidity Incentives → 300 million $YB (30 %) reserved for ongoing emissions under a dynamic schedule. Early LPs → 11.25 million YB split into two seasons:

• Season 1 → 5.625 million $YB, 12-month linear vesting starting immediately.

• Season 2 → 5.625 million $YB, 12-month vesting starting 3 months after TGE.

This structure aligns long-term participants with protocol growth. Liquidity providers and veYB holders share the same emission stream, ensuring incentives evolve with network activity.