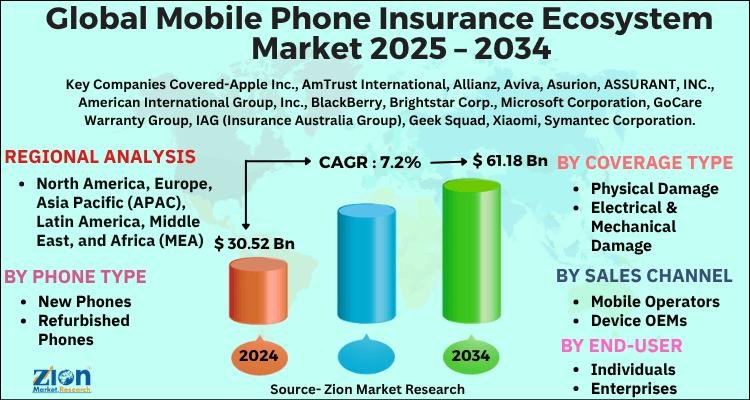

The global mobile phone insurance ecosystem market, valued at USD 30.52 Billion in 2024, is projected to double and reach USD 61.18 Billion by 2034, expanding at a robust CAGR of 7.2% between 2025 and 2034.

This growth is powered by rising smartphone usage, increasing theft & damage cases, high replacement costs, and bundled insurance offerings by telecom operators and OEMs.

🌐 Mobile Phone Insurance Ecosystem: Market Overview

Smartphones have become an indispensable part of modern life, with people relying on them for communication, business, payments, and entertainment. Damage, theft, or loss of these devices creates significant disruption, making insurance coverage a necessity.

The mobile phone insurance ecosystem refers to an integrated network of insurers, operators, retailers, and tech providers that deliver customized insurance solutions, claims management, and customer services.

Access a Sample Report with Full TOC and Figures @ https://www.zionmarketresearch.com/sample/mobile-phone-insurance-ecosystem-market

Insurance providers are leveraging AI, blockchain, and IoT to improve risk assessment, reduce fraud, and provide seamless customer experiences.

📊 Key Market Insights

Market Size (2024): USD 30.52 Billion

Forecast (2034): USD 61.18 Billion

CAGR (2025-2034): 7.2%

Leading Phone Type: New Phones

Top Coverage Type: Physical Damage

Sales Channel Leader: Mobile Operators

End-user Dominance: Individuals

Regional Leader: North America

🚀 Growth Drivers

📱 Surging Smartphone Penetration – Over 6.5 billion global smartphone users increase insurance adoption.

💸 High Repair & Replacement Costs – Flagship devices cost USD 800-1500+, driving protection demand.

🛡️ Bundled Insurance Plans – Offered by OEMs, mobile operators, and retailers.

🌐 Digital Distribution – Rising e-commerce and app-based policy sales expand reach.

🔄 Device Leasing & Trade-in Programs – Boosts ecosystem adoption.

⚠️ Market Restraints

High Premium Costs discourage adoption in price-sensitive markets.

Lack of Transparency in policy terms confuses customers.

🌟 Opportunities

📦 E-commerce Expansion – Online platforms emerging as major distribution channels.

🤖 AI & Blockchain Integration – Enhances fraud detection & claims automation.

🛠️ Personalized Insurance Models – Pay-as-you-go and usage-based plans gaining traction.

⌚ Coverage Beyond Smartphones – Growth in IoT devices & wearables insurance.

🛑 Challenges

🚨 Fraudulent Claims – A growing concern for insurers.

🔐 Cybersecurity Risks – Customer data protection critical.

📜 Regulatory Compliance – Varying legal frameworks across regions.

🔍 Market Segmentation

By Phone Type

New Phones (dominant segment)

Refurbished Phones

By Coverage Type

Physical Damage (fastest growing)

Electrical/Mechanical Breakdown

Theft & Loss

Virus & Malware Protection

Others

By Sales Channel

Mobile Operators (largest share)

OEMs

Retailers

Online

Banks

By End-user

Individuals (leading)

Enterprises

Want to know more? Read the full report here: https://www.zionmarketresearch.com/report/mobile-phone-insurance-ecosystem-market

🌍 Regional Insights

North America – Leading market, driven by high smartphone penetration, AI adoption, and bundled plans.

Europe – Significant growth supported by regulatory frameworks and premium device adoption.

Asia-Pacific (APAC) – Fastest growing due to rising smartphone demand in India, China, and Southeast Asia.

Latin America & MEA – Growing adoption with rising mobile connectivity.

🏢 Key Market Players

Apple Inc.

Assurant Inc.

Asurion

Allianz

AmTrust International

Aviva

American International Group (AIG)

Samsung Electronics

Microsoft Corporation

Xiaomi

Sony Mobile Communications

LG Electronics

Brightstar Corp.

IAG (Insurance Australia Group)

Geek Squad

GoCare Warranty Group

(and others)

💡 Recent Developments:

Apple (2021): Expanded AppleCare+ with coverage up to 5 years.

Assurant (2021): Acquired HYLA Mobile to boost device trade-in & refurbishment.

SquareTrade (2021): Launched Lost & Stolen Protection with coverage up to USD 1,000.

✅ Conclusion

The mobile phone insurance ecosystem market is set to grow rapidly, doubling in size by 2034. With North America dominating and APAC rising, insurance providers are focusing on digital channels, AI-driven fraud detection, and bundled protection plans. As smartphones become more expensive and essential, demand for insurance will continue to surge globally.

Click On This Below Link to See Similar Reports :

Aromatic Market https://www.zionmarketresearch.com/report/aromatic-market

Positron Emission Tomography Market https://www.zionmarketresearch.com/report/positron-emission-tomography-market

Civil Aviation Market https://www.zionmarketresearch.com/report/civil-aviation-market

Flexible Paper Packaging Market https://www.zionmarketresearch.com/report/flexible-paper-packaging-market

Scaffolding Market https://www.zionmarketresearch.com/report/scaffolding-market

Asia Pacific Office

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

📞 US OFFICE NO +1 (302) 444-0166

📞 US/CAN TOLL FREE +1-855-465-4651

📧 Email: sales@zionmarketresearch.com

🌐 Website: http://www.zionmarketresearch.com

In addition to providing our clients with market statistics released by reputable private publishers and public organizations, we also provide them with the most current and trending industry reports as well as prominent and specialized company profiles. Our database of market research reports contains a vast selection of reports from the most prominent industries. To provide our customers with prompt and direct online access to our database, our database is continuously updated.

This release was published on openPR.