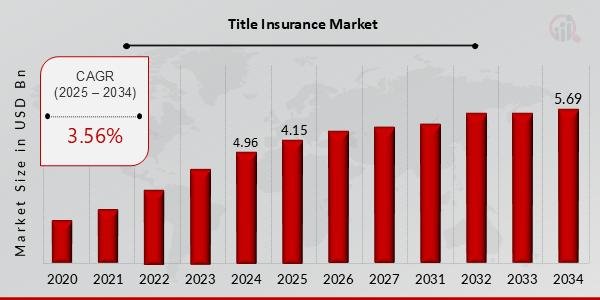

The global title insurance market, valued at an estimated $4.96 billion in 2024, is poised for sustained expansion, projected to reach $5.69 billion by 2034. This growth trajectory represents a Compound Annual Growth Rate (CAGR) of 3.56% during the forecast period of 2025 to 2034, driven by a confluence of factors including a flourishing real estate market, technological advancements, and increasing awareness of risk mitigation in property transactions.

Title insurance plays a crucial role in real estate, safeguarding property owners and lenders against potential losses arising from defects in a property’s title. These defects can include undisclosed liens, encumbrances, conflicting ownership claims, or errors in public records. As real estate transactions continue to increase globally, so does the demand for this essential protection.

Get a Free PDF Sample: https://www.marketresearchfuture.com/sample_request/33855

Key Drivers Propelling Market Expansion:

• Rise in Real Estate Transactions: The primary catalyst for the title insurance market’s growth is the escalating volume of real estate transactions, encompassing both residential and commercial properties. Urbanization and population growth fuel the demand for housing and business spaces, leading to more property purchases, sales, and refinances. Each of these transactions necessitates title insurance to ensure a clear and marketable title.

• Growing Awareness of Title Insurance Benefits: As property values rise and the complexities of real estate transactions increase, both individual buyers and enterprises are becoming more aware of the financial risks associated with title defects. This heightened understanding is driving greater adoption of title insurance policies.

• Technological Advancements and Digital Transformation: The title insurance industry is actively embracing digitalization. The integration of technologies such as artificial intelligence (AI), blockchain, and automation is revolutionizing title search, examination, and claims management processes. These advancements enhance efficiency, accuracy, and transparency, reducing turnaround times and attracting tech-savvy customers. Online platforms are also making the purchasing process more convenient and accessible.

• Regulatory Changes and Compliance: Stringent regulatory frameworks in many regions mandate or strongly encourage the use of title insurance, further contributing to market growth. These regulations aim to protect property ownership and ensure secure transfers.

• Increased Mortgage Lending: As more individuals and businesses secure mortgage loans to purchase properties, the demand for lender’s title insurance, which protects the lender’s investment, is expected to surge.

Browse Complete Research Report: https://www.marketresearchfuture.com/reports/title-insurance-market-33855

Opportunities and Emerging Trends:

The forecast period presents significant opportunities for the title insurance market. Untapped markets in developing economies, with their rapid urbanization and rising property ownership rates, offer considerable potential for expansion. Continuous investment in technology-driven solutions will further streamline processes, improve customer experience, and potentially lead to cost savings.

Strategic partnerships with real estate developers, mortgage lenders, and financial institutions are also anticipated to create synergies and foster market growth. Furthermore, the increasing focus on environmental, social, and governance (ESG) practices may also influence the industry, with a greater emphasis on sustainable and secure property transactions.

Buy Premium Research Report: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=33855

Challenges and Outlook:

Despite the positive outlook, the title insurance market is not without its challenges. Economic volatility, including fluctuating interest rates and potential economic downturns, can impact real estate activity and, consequently, the demand for title insurance. High premium costs can also be a barrier in some regions, particularly where title insurance is not legally mandated.

Cybersecurity threats pose a significant risk, as title companies handle sensitive financial and personal information. Robust cybersecurity measures and ongoing education are crucial to combat wire fraud and data breaches. Workforce challenges, including attracting and retaining younger talent, also need to be addressed.

Looking ahead, the title insurance market is expected to continue its journey of recovery and growth. Industry players are focusing on operational efficiency, technological adoption, and strategic diversification to navigate the evolving landscape. The industry’s fundamental role in facilitating secure real estate transactions, combined with ongoing innovation, positions it for a stable and positive future.

Related Reports:

India Personal Loans Market https://www.marketresearchfuture.com/reports/india-personal-loans-market-44270

UK Personal Loans Market https://www.marketresearchfuture.com/reports/uk-personal-loans-market-44264

US Personal Loans Market https://www.marketresearchfuture.com/reports/us-personal-loans-market-19694

Brazil Digital Payment Market https://www.marketresearchfuture.com/reports/brazil-digital-payment-market-44834

GCC Digital Payment Market https://www.marketresearchfuture.com/reports/gcc-digital-payment-market-44832

Mexico Digital Payment Market https://www.marketresearchfuture.com/reports/mexico-digital-payment-market-44833

South Korea Digital Payment Market https://www.marketresearchfuture.com/reports/south-korea-digital-payment-market-44831

US Financial App Market https://www.marketresearchfuture.com/reports/us-financial-app-market-12731

US Mobile Payments Market https://www.marketresearchfuture.com/reports/us-mobile-payments-market-13509

US Automotive Insurance Market https://www.marketresearchfuture.com/reports/us-automotive-insurance-market-14063

Market Research Future (MRFR) is a global market research company that takes pride in its services, offering a complete and accurate analysis regarding diverse markets and consumers worldwide. Market Research Future has the distinguished objective of providing the optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Market Research Future

99 Hudson Street,5Th Floor

New York, New York 10013

United States of America

Sales: +1 628 258 0071(US)

+44 2035 002 764(UK

Email: sales@marketresearchfuture.com

This release was published on openPR.